What you need to know about AAIG

This is branded content.

Amalgamated Australian Investment Group (AAIG) is known for providing high-level investment tools in an accessible way to investors both private and institutional investors.

From ready-made investment portfolios to investing reports, AAIG uses a range of products to educate and support clients and users in the world of investing.

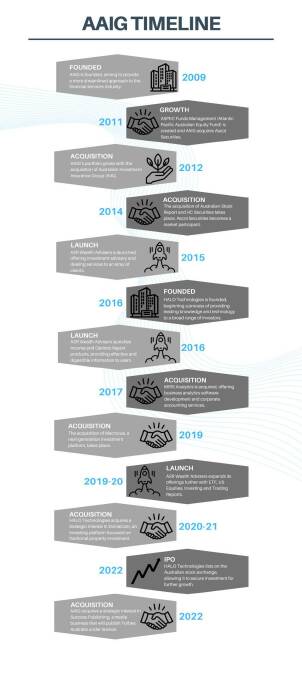

Let's take a comprehensive look at AAIG's history, from its inception to its various product launches and acquisitions.

What is AAIG?

AAIG was established in 2009. It is a privately held equity firm with the goal of bringing together different areas of finance to make things easier for clients.

AAIG has actualised this goal with products and technologies that investors and AAIG shareholders can use on their financial journeys.

What products does AAIG offer?

AAIG's acquisition strategy has led to a diverse and comprehensive portfolio of established companies within the sector. Companies including the Australian Stock Report and Ascot Securities sit within AAIG's management.

Growth is the major priority of AAIG, which has led to the development of these businesses. As a result, the businesses have seen increased market shares and long-term value.

This has benefitted the clients of the businesses, as well as their shareholders.

The work AAIG has done to create a singular association of investment businesses has allowed global markets to easily access and use a wide array of innovative financial products.

Wholesale, private and institutional clients can utilise the services of these companies through a single access point.

Companies Under AAIG's Portfolio

As previously established, AAIG's portfolio consists of a number of financial services companies. These businesses each offer excellent services in their own right.

Taken as a whole, they provide extremely extensive expertise, resources and advice to clients.

Specialised areas include insurance, wealth management, corporate advisory, financial planning and stockbroking. As a result, AAIG's clients can make financial decisions with greater efficiency and with a stronger knowledge base.

Group companies

Australian Stock Report

Australian Stock Report uses quality equity research to distribute high-quality information to readers and clients. ASR has a circulation base of 250,000 readers, and clients including traders, investors and trustees of self-managed super funds.

ASR Wealth Advisers

ASR Wealth Advisers has a wide range of clients to whom it provides both general advice and dealing services. Its offerings include domestic and international equities, managed funds, corporate advisory services and trade execution.

Ascot Securities

Ascot Securities boasts over 20 years of experience providing specialised stockbroking and advisory services. As an ASX Market Participant, it provides direct execution capability to institutional and private clients.

ASPEC Funds Management

APSEC Funds Management is the investment manager for a registered investment scheme. This scheme has the primary objective of succeeding across all investment cycles by generating strong capital and income returns.

Australian Investment and Insurance Group

An ASFL, Financial Planning Firm and Dealer Group, Australian Investment and Insurance Group uses a traditional personal advice model to deliver financial planning services to clients. In addition, it offers compliance services to wholesale and B2B dealer groups.

HC Securities

HC Securities is a corporate authorised representative No 297316 of AAIS ASFL. It offers general advice and dealing services in securities.

MIRS Analytics

MIRS Analytics helps to provide crystal-clear visibility of complex financial networks with business analytics software development and corporate accounting services.

Partners

HALO Technologies

HALO Technologies has cemented its place as a leading global provider and developer of financial services and technology. It combines expert knowledge and superior technology to supply everyday investors with everyday investors.

DomaCom Australia

As the operator of an investment platform, DomaCom Australia will use the newest technology and share market concepts to enable investors to get into the fractional property market in a similar way to investing in public companies.

Success Publishing

An innovative media business based in Sydney, Success Publishing is set to publish Forbes Australia under licence. Success Publishing was founded by entrepreneurial group Success Global Media.

Resilient Fund Managers

Resilient Fund Managers was founded in 1990, operating in the open-ended investment companies sector. In 2023, it was acquired by HALO Technologies.

The history of AAIG

AAIG's portfolio of financial and investment services has been carefully curated since its inception in 2009.

The history of the group reflects how it plans to maintain its growth in the future.

2009

AAIG is founded, with the goal of providing a more streamlined approach to the financial services industry.

2011

ASPEC Funds Management (Atlantic Pacific Australian Equity Fund) is created and AAIG acquires Ascot Securities.

2012

AAIG's portfolio grows with the acquisition of Australian Investment & Insurance Group (AIIG).

2014

The acquisition of Australian Stock Report and HC Securities takes place. Ascot Securities becomes a market participant.

2015

ASR Wealth Advisers is launched, offering investment advisory and dealing services to an array of clients.

2016

HALO Technologies is founded, beginning a process of providing leading knowledge and technology to a broad range of investors.

ASR Wealth Advisors expands its offerings with Income and Options Report products. These products provide effective and accessible information to users.

2017

The acquisition of MIRS Analytics takes place. MIRS Analytics offers services including business analytics software development and corporate accounting.

2019

The acquisition of Macrovue, a next-generation investment platform, takes place.

2019-20

ASR Wealth Advisers expands its offerings further with ETF, US Equities, Investing and Trading Reports.

2020-21

HALO Technologies acquires a strategic interest in DomaCom, an investing platform focussed on fractional property investment.

2022

HALO Technologies lists on the Australian Stock Exchange, allowing it to secure investment for further growth.

AAIG acquires a strategic interest in Success Publishing, a media business that will publish Forbes Australia under licence.

AAIG's plans for future growth

1 - Increase Strategic Acquisitions

AAIG's primary goal is growth. To achieve this goal, the further acquisition of financial services and corporations is a top priority. These acquisitions are designed to provide even greater resources and access for AAIG clients and shareholders. They will also develop the financial umbrella of AAIG for extensive industry advancement.

2 - Develop Current Portfolio Companies

AAIG has developed financial services companies such as AAIG to allow clients to get the most out of these organisations. AAIG will expand upon this strategy in the future. The expansion of AAIG's portfolio in this manner is evidenced by recent acquisitions such as DomaCom.

3 - Research and Adapt to Emerging Industries

AAIG also hopes to investigate future research opportunities. Potential areas of focus include the development of artificial intelligence and the potential impact it will have on the current state of financial services. This work will allow AAIG to improve its range of capabilities and resources for clients.